GENERATION IACP

We are a team of portfolio managers and capital partners dedicated to helping clients achieve their goals.

At Generation we serve our clients through two distinct areas:

INVESTMENT ADVISORY

Provides discretionary managed accounts on behalf of high net worth individuals and institutions. Learn more.

CAPITAL PARTNERS

We work with corporate clients offering a range of financing and advisory services to achieve their objectives. Learn more.

GENERATION IACP INVESTMENT ADVISORY

Stewards of your wealth

From one generation to the next

Since its establishment in 1998 by Herb and Randall Abramson (along with its affiliated firm, Generation PMCA Corp., in 1999), Generation IACP has maintained its culture of investment excellence. The investment landscape has changed dramatically, yet Generation IACP has stayed at the forefront by continuously improving its analytics and numerous proprietary investment systems.

Experience

The firm’s portfolio managers and analysts bring years of experience to asset allocation, portfolio construction, security selection and client service.

Independence

Simply put, our goal is to grow and protect your wealth. As an independent firm, we are not incentivized to sell expensive investment products that are not right for you.

History of Innovation

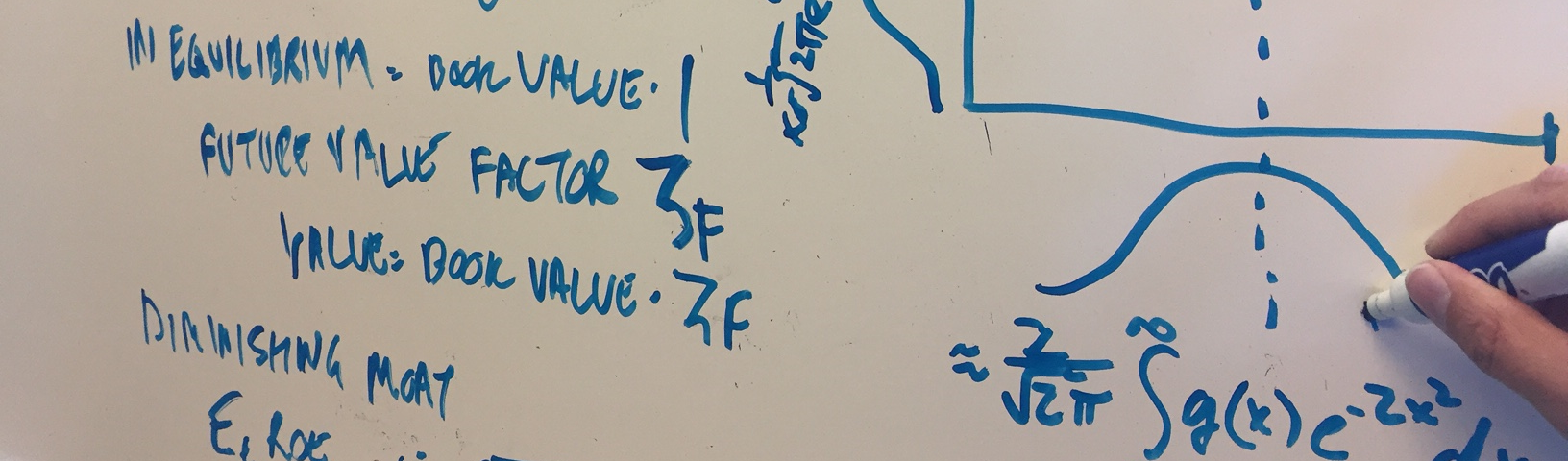

Our team has a long history of building innovative proprietary research systems, investment methodologies, and risk management systems.

Global

U.S. and Canada comprise only about half of global stock market capitalization. Our go anywhere approach provides more opportunities.

Fundamental Research

As value investors we invest in companies that we believe are temporarily trading below our estimated appraised values. We prefer businesses with strong competitive advantages led by management teams incentivized to maximize return on capital.

Risk Management

We monitor global economies and markets to alert us to potential economic downturns or severe market declines.

20 Years of Investment Innovation

1998 – 2008

After many years as Portfolio Managers at leading investment firms, Herb Abramson and Randall Abramson team up to start Generation IACP. Firm innovates with quantitative models and distinguishes itself as an all-cap value manager.

Highlights from the last 15 years

2010

Development of TRIMTM, an algorithm that combines market volatility and momentum to forewarn of market regime transitions.

2011

Development of TECTM, an economic model used to identify economic cycle peaks and troughs.

2012

Launch of the Global Insight Model, our large cap global long/short value strategy that utilizes a parallel risk management process to guard against economic and market risk.

2015

Generation IACP’s first quantitative strategy, the Quantitative Global Value Model launches.

2018

Launch of the hybrid version of our Global Insight Model, Global Insight Duteras, which combines quantitative and fundamental approaches.

2019

Launch of our Investment Grade Bond Model which utilizes a quantitative approach to identify Canadian investment grade opportunities.

Our goal is

simple:

To develop

world class

equity,

income,

and alternative

investment

strategies.

Careers At Generation IACP

At Generation IACP we’re committed to investment excellence and client satisfaction.

Joining our boutique, employee-owned firm means becoming part of a dynamic and fast-moving group of investment professionals. You’ll receive the freedom and flexibility needed to grow your business and skill set the way you want to.

Current Openings

GENERATION IACP

We are a team of portfolio managers and capital partners dedicated to helping clients achieve their goals.

At Generation we serve our clients through two distinct areas:

INVESTMENT ADVISORY

Provides discretionary managed accounts on behalf of high net worth individuals and institutions. Learn more.

CAPITAL PARTNERS

We work with corporate clients offering a range of financing and advisory services to achieve their objectives. Learn more.

GENERATION IACP INVESTMENT ADVISORY

Stewards of your wealth

From one generation to the next

Since its establishment in 1998 by Herb and Randall Abramson (along with its affiliated firm, Generation PMCA Corp., in 1999), Generation IACP has maintained its culture of investment excellence. The investment landscape has changed dramatically, yet Generation IACP has stayed at the forefront by continuously improving its analytics and numerous proprietary investment systems.

Experience

The firm’s portfolio managers and analysts bring years of experience to asset allocation, portfolio construction, security selection and client service.

History of Innovation

Our team has a long history of building innovative proprietary research systems, investment methodologies, and risk management systems.

Fundamental Research

As value investors we invest in companies that we believe are temporarily trading below our estimated appraised values. We prefer businesses with strong competitive advantages led by management teams incentivized to maximize return on capital.

Independence

Simply put, our goal is to grow and protect your wealth. As an independent firm, we are not incentivized to sell expensive investment products that are not right for you.

Global

U.S. and Canada comprise only about half of global stock market capitalization. Our go anywhere approach provides more opportunities.

Risk Management

We monitor global economies and markets to alert us to potential economic downturns or severe market declines.

20 Years of Investment Innovation

Our goal is simple: to develop world class alternative, equity, and income investment strategies.

1998 – 2008

After many years as Portfolio Managers at leading investment firms, Herb Abramson and Randall Abramson team up to start Generation IACP. Firm innovates with quantitative models and distinguishes itself as an all-cap value manager.

Highlights from the Last 15 Years

-

Development of TRIMTM, an algorithm that combines market volatility and momentum to forewarn of market regime transitions.

-

Development of TECTM, an economic model used to identify economic cycle peaks and troughs.

-

Launch of the Global Insight Model, our large cap global long/short value strategy that utilizes a parallel risk management process to guard against economic and market risk.

-

Generation IACP’s first quantitative strategy, the Quantitative Global Value Model launches.

-

Launch of the hybrid version of our Global Insight Model, Global Insight Duteras, which combines quantitative and fundamental approaches.

-

Launch of our Investment Grade Bond Model which utilizes a quantitative approach to identify Canadian investment grade opportunities.

-

Launch of Generation IACP’s Sharia-Compliant Global Equity Model, the first global equity strategy certified as Sharia-Compliant by Canada’s Islamic Finance Board.

Careers At Generation IACP

At Generation IACP we’re committed to investment excellence and client satisfaction.

Joining our boutique, employee-owned firm means becoming part of a dynamic and fast-moving group of investment professionals. You’ll receive the freedom and flexibility needed to grow your business and skill set the way you want to.